Welcome to

Dolly Varden Silver

Building Shareholder Value by Growing Resources of Silver and Gold in a Safe Jurisdiction

- Are you concerned that extraordinary money printing by central banks will result in sustained 1970s style inflation during this decade?

- Are you worried your standard of living will be reduced as a result?

- Do you value precious metals as a hedging component in your portfolio against inflation and global systemic risks?

- Do you see the growth opportunity in green metals like silver to power our electric future?

- Are you an investor looking to gain leverage to precious metals prices through companies advancing gold and silver projects?

If you answered YES to ANY of these questions, sign up NOW to the Dolly Varden Silver VIP Investor email list to receive information on our company and how you too may benefit from our future.

Why sign up?

Because at Dolly Varden Silver we’re building gold and silver resources for investors like you who want to seize the opportunity of this decade. Sign Up For The Dolly Varden VIP List And Be The First To Receive The Latest News Releases & Industry Information!

Why are we building gold and silver resources?

Because we too are precious metal investors, just like you, who are building a company to gain maximum leverage to precious metals.

Learn about our game changing acquisition of the Homestake Ridge project from Fury Gold Mines as we continue to build resources of silver and gold!

About Me

Shawn Khunkhun,

CEO, PRESIDENT & DIRECTOR

Hi, I’m Shawn Khunkhun and in January 2020 I became CEO of Dolly Varden Silver because I saw a company with an incredible asset and an opportunity to build shareholder value.

While I had no idea we were about to face a pandemic, my timing of starting just before couldn’t have been better as the economic backdrop has been very supportive of precious metals. And as I will describe here, I believe will continue likely for the next decade.

While I wouldn’t be surprised to see wild swings in the prices of all assets this decade, I believe in the long-term store of value and potential of silver and gold in the 2020s.

As I said, I’m a precious metals investor and with Dolly Varden’s existing resources of silver I knew it was an excellent vehicle to gain leverage to rising silver prices with a potential to unlock value in a future mining scenario.

And like me, with all the incredible changes in the last few years, you’re probably wondering where this crazy world is headed and how precious metals fit into it.

Personally, I see the trends in the world and I’m worried. I’m worried about our future. I’m worried about the future for my kids, for my neighbours and my country.

And with the Covid 19 Pandemic things have got to the point where money is being printed at a rate even I didn’t expect!

While the pandemic appears over and the money printing is abating, I believe the economic fallout from what has taken place will be felt for years to come.

In fact, during the next decade I wouldn’t be surprised to see further bouts of central bank money printing to support the financial system, so I don’t believe this story is over. And unfortunately, I don’t think it will end well…

While inflation is bad for the broader economy, it is terrible on a personal level since it robs us of our purchasing power.

While money printing and loss of our purchasing power is bad enough on its own, the money that has been printed was used to buy bonds and mortgages to purposely lower interest rates. And in recent years interest rates have fallen to lows never-before-seen in the history of the world!

In some countries interest rates have even fallen below ZERO… negative interest rates where you must pay someone to hold your money!

And recently the money printing has not just reduced interest rates… in the US its driven-up inflation to 40-year highs.

Every year the numbers seem to get worse!

This process of money printing to buy bonds is a double whammy to savers. Not only do they receive less interest, inflation is reducing the purchasing power of their money every year!

For instance, a government bond paying 1% interest every year when combined with inflation running at 5% means you are actually losing 4% of your purchasing power every year. That is a -4% return, a figure called the “real yield”, ie. after inflation. And that is if you believe government inflation statistics!

Compound -4% over 10 years and you have lost 46% of the value of your currency. A guaranteed loss… in the safest investment?

Once investors wake up to this risk, it will be too late.

And many economists question whether central banks and governments have the will power to stop this process before inflation spirals out of control.

Don’t get me wrong… I’m not a financial advisor.

I don’t have a crystal ball. However, I see the writing on the wall, as do many of the top investors in the world including billionaire fund managers Ray Dalio and Jeffrey Gundlach who are advocating “all weather portfolios” of near equal weighting of bonds, equities, cash and commodities including gold and silver.

While I don’t know what the future holds, and I’m sure we will experience both bouts of inflation and possibly short-term deflation in the coming decade, I do know one way to protect from inflation over long periods of time is gold and silver.

Why? Because simply put gold and silver are real and rare and simply can’t be printed out of thin air, unlike our currency.

Historically over ten-year periods gold and silver have provided investors a means of escaping inflation and the negative real yield trap we have recently experienced.

For thousands of years gold and silver have protected people time and again.

Our “modern” financial system of fiat money backed by central banks is keeping us locked in negative real rates that destroy our wealth and force us to take on more and more risk to earn a return.

We see this today in the incredible speculation in cryptocurrencies, long bonds, tech stocks and more.

Fortunately, gold and silver are a store of value and will continue to be a store of value due to their beauty and incredible industrial properties which we will get to in a moment.

Regardless of the economic issues and incredible volatility in asset prices we may see in the years to come, I believe in the future of precious metals as do many other professional investors.

Sign Up For The Dolly Varden VIP List Now

Seeking Precious Metals in an Uncertain Global Economy

Speculation caused by the low cost of borrowing, ie. low interest rates, is bordering on insanity in many assets around the world.

In a 2022 Bloomberg interview, renowned value investor Jeremy Grantham stated he believes we are in a super bubble larger than 1929 and it will at some point experience a bust greater than the 1930s.

While I don’t know when the bubble will burst, my questions is this…“when the bubble bursts, how much more money will need to be printed to support falling asset prices?”

Adding to the risks of speculation and bubbles in asset prices, the world economy is undergoing incredible changes with 1st, 2nd and 3rd order effects that we can only speculate on!

What will be the impact of new technologies that will certainly change our world?

The commercialization of new technologies including electric vehicles, artificial intelligence, robotics, autonomous driving and the like mean our future is uncertain. We don’t know how they will change our lives, our economy or the value of our investments.

Many of the companies pioneering these technologies are completely revolutionizing their industries to the point where the survival of old established companies is threatened.

What we do know is that many of these new green/electric technologies require precious metals due to their incredible electrical conductivity. After all silver is the world’s most electrically conductive metal which is why it is required in PV solar cells to efficiently harness the sun’s electrons.

To some degree the future of the world has never been so uncertain and top investors from the likes of Mr. Dalio and Mr. Gundlach are preaching diversification with gold and silver as a foundation to a portfolio.

These investors who actively manage hundreds of billions of dollars are also advocating investing in natural resource companies which in the last 10 years have significantly lagged the performance of the general market, and more specifically, the share appreciation of technology stocks which Grantham believes are in a bubble.

Obviously, I too believe physical gold and silver are a great sore of wealth and I have a percentage of my portfolio in them.

However, I like to focus on mining companies which find and later extract these valuable metals out of the ground as there is the potential for even more value to be generated from them than bullion.

Why gold and silver mining companies?

While physical gold and silver is an inflation hedge, over long periods of time, mining companies that produce gold and silver have traditionally seen even stronger returns during times of inflation.

With higher rates of inflation, gold and silver generally see higher prices and therefore companies that produce them see higher revenue. Provided costs don’t grow at the same rate, their earnings, cashflows, dividends and share prices can grow. Historically their share prices often grow at much higher rates of return than those of the underlying commodities, providing investors natural leverage.

This leverage of mining company earnings to higher commodity prices is well know on Wall Street and is one of the reasons why professional investors and investment funds buy mining companies. In addition, mining companies often have the ability to make investments in their mines to improve efficiencies which can further increase the returns to their stockholders.

Non-producing mining companies with resources of gold and silver can provide even more natural leverage.

While mining companies have higher risk and reward than owning physical gold and silver, companies with deposits of the metals that haven’t yet been developed into mines have even higher risk and higher return potential.

Why? Because companies with resources of gold and silver that aren’t yet producing trade at a steep discount to their producing counterparts because they need additional work de-risk their projects and don’t yet have cash flow from operations to fund their advancement.

No, I’m not talking about pure exploration companies without resources of gold and silver in the ground. Those are lottery tickets. I’m talking about companies with existing deposits of metal that have invested heavily in exploration, drilling and studies… that have potentially economic resources.

The bottom line is, earlier stage companies that have invested heavily to grow resources of gold and silver have the potential for leveraged returns to metal prices.

Why? Because as the prices of the commodities increase, the value of their deposits of gold and silver increase which causes their share price to increase.

Furthermore, as prices of gold and silver increase the economic viability of their projects increase since the likelihood their projects get developed increases. This can cause a re-rating by analysts which in turn causes further appreciation in their stock and returns for their shareholders.

For instance, companies with resources of gold and silver have been known to have over 3 times leverage to changes in the commodity price. That means if silver were to go up 100%, a junior company could see its stock price increase 300% or more.

And when companies are efficiently growing their resources of gold and silver through discovery or other accretive ways, this adds even more leverage to potential returns.

In addition, companies who are able to de-risk their projects can generate further returns to shareholders as they increase the potential their metal deposits could be put into production as mines.

Add on top of this is the potential for acquisition.

If the company you own is ultimately purchased by a senior company, the potential for returns further increases as the acquiror usually must pay a premium to the market price.

This is our ultimate goal for Dolly Varden Silver, as we will get to in a moment.

How do companies grow resources of precious metals?

In mining, there are two ways to grow resources:

- Either you find more through discovery, or

- You acquire more by purchasing another project through an accretive deal.

Discovery consists of using various exploration techniques and technologies to find physical anomalies that have the potential to host minerals. Then, using a drill rig you drill into the rock to confirm if the valuable metals exist.

Once a discovery hole is made, it is a question of doing more drilling to determine the size and grade of the deposit to determine if it is economically viable to be built into a mine.

Exploring for minerals in moose pasture is risky. That’s why most successful exploration occurs near existing mineral deposits or past producing mines where gold and silver have already been discovered.

The other way to grow resources is through acquisition and the best acquisitions are accretive.

What is an accretive acquisition? It is when you acquire resources at a great price to add to yours which is what we believe we have just done.

Dolly Varden’s Game Changing Homestake Ridge Acquisition

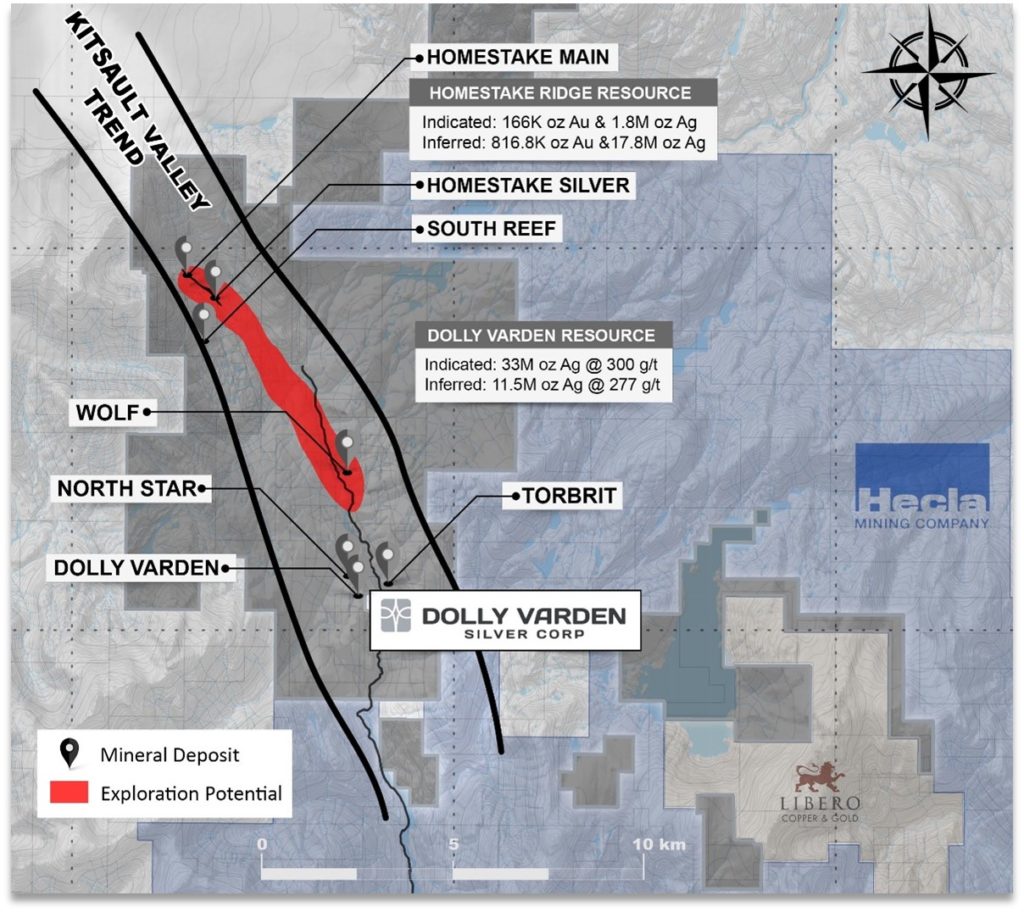

On February 25, 2022 we acquired the neighboring Homestake Ridge project from Fury Gold Mines Ltd. in an accretive acquisition for Dolly Varden shareholders.

The combined 100% held project known as the Kitsault Valley project nearly triples the resources of precious metals (as we will get to in a moment) and is a win/win for both Fury and Dolly Varden shareholders.

Our project NOW includes seven known silver and gold deposits of which two are past producing silver mines.

It also consolidates a 15 km mineralized trend and opens up 5.4kms of underexplored ground for potential future discovery.

Buy companies with gold and silver resources in the ground at less than the premium over spot?

With the economic situation facing Western nations including record government deficits, inflation at 40-year highs and the prospect of further increasing rates of inflation, investors are demanding gold and silver!

For example, in 2020, 2021 and 2022 we have seen growing demand for physical metals and with them higher prices.

While this is great for the precious metals, investors in bullion are now having to pay steep premiums for bars and coins because the supply simply hasn’t been there.

In the case of silver, which is a small metal market, in 2021 we saw premiums over spot of $5-10 per ounce which costs the small investor dearly. That’s right 20-40% above the spot price of silver.

And while bullion investors are paying $5-10 over spot per ounce, silver juniors while presenting different risks and rewards than bullion can be purchased at just $1-5 per ounce of silver for their in the ground resources.

A question some investors are asking is; why buy physical silver at a $5-10 per ounce premium when you can buy companies with gold and silver resources in the ground at less than the premium?

While there is no doubt the stocks are a different investment than bullion, they have similarities. One way to think of bullion is as silver or gold in your hand, where as juniors represent the potential for silver and gold to be in your hand at some point in the future. As a result, silver juniors trade at a significant discount to bullion.

The bottom line is this, precious metal juniors equities are valued based on the value of the resources of silver and gold they have in the ground. And they often trade at a steep discount to the Net Asset Value, ie. the discounted cash flows of their potential mines.

And because of the inherent natural leverage of their projects, they can offer incredible leverage to movements in the metal prices… both up and down.

While I am not an investment advisor, and suggest you consult with one, I like to always stay diversified when investing.

Which is why I believe in owning physical gold and silver as a foundation for my portfolio, then include companies with precious metal resources, especially when looking at the prospect of paying very high premiums for physical.

Why Dolly Varden Silver?

Resources in a Safe Jurisdiction.

As I said earlier, at Dolly Varden Silver we’re building a precious metals company for investors just like you because we are mining investors.

We know what we look for in a mining investment and that is the potential for outsized returns with reduced risk.

Which is why we’re focused on growing resources of high-grade silver and gold in a safe jurisdiction, Canada, to gain leverage to rising prices and gain from the value of advancing our project.

I believe having a project in a safe jurisdiction is key, and as we will discuss more in a minute, will likely grow in importance in the years to come, providing further returns to shareholders.

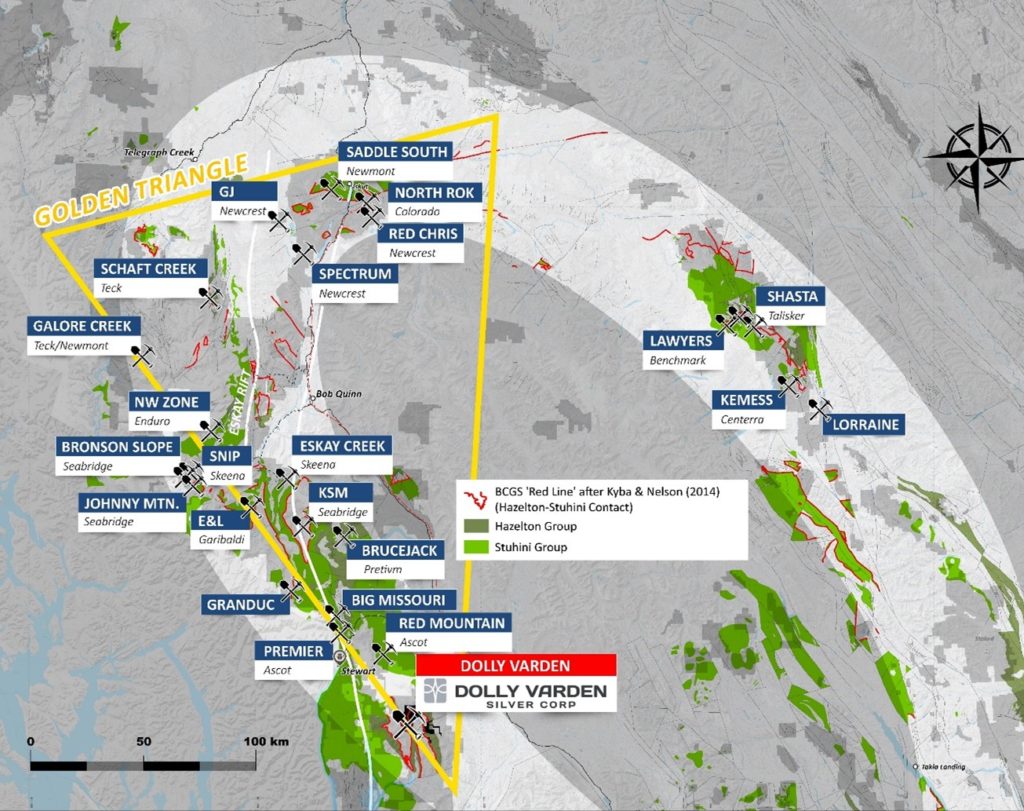

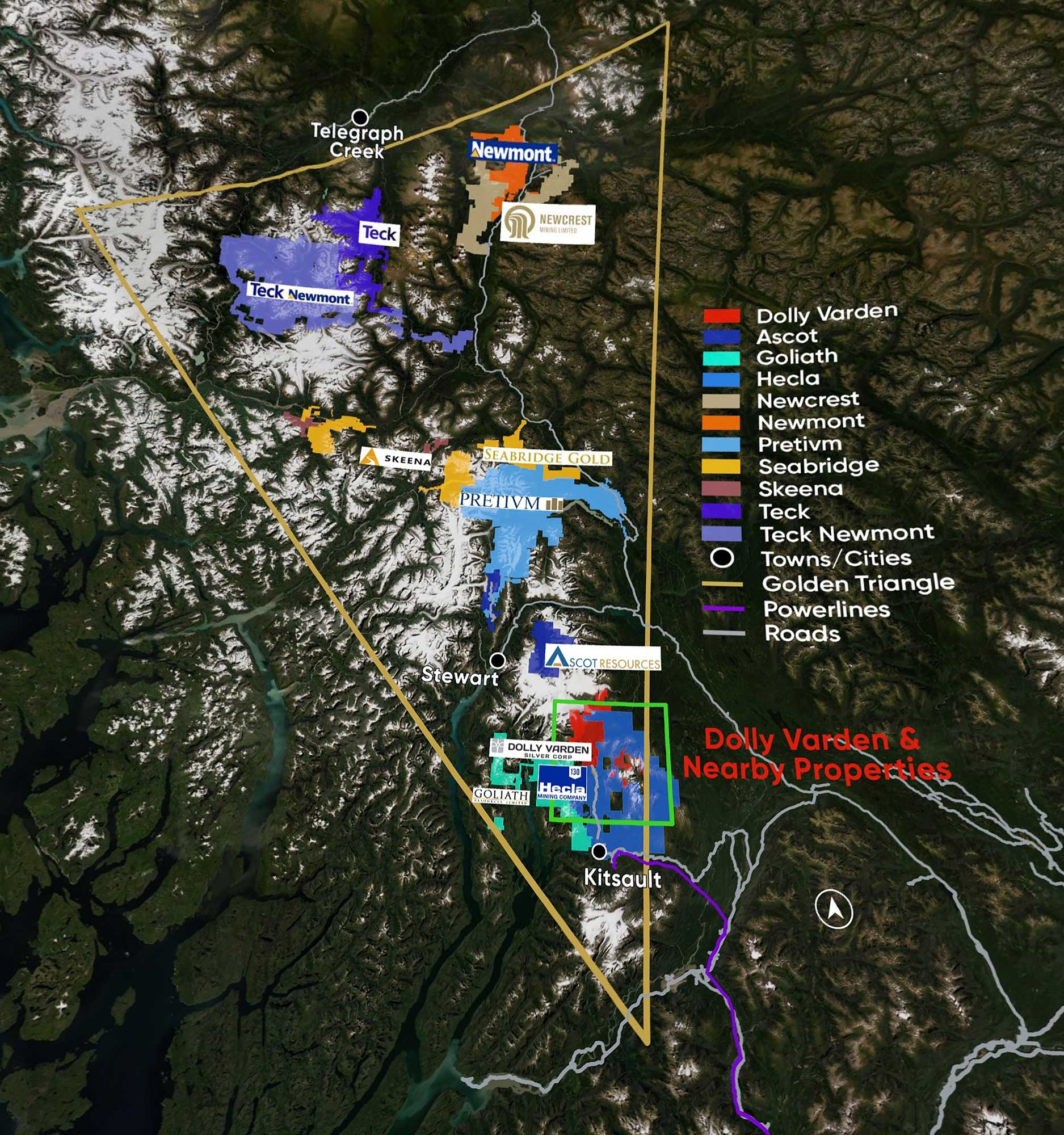

Our 100% held Kitsault Valley project is located in the Golden Triangle of British Columbia, Canada. Projects in the area include those owned by some of the largest mining companies in the world including Barrick Gold, Hochschild Mining, Newmont, Newcrest Mining and more.

Why is a pure play precious metals company important?

As a precious metal investor you want maximum leverage to the price of precious metals, not base metals. And with our 100% silver and gold resources, Dolly Varden provides investors with leverage.

Resources are a very important foundation because they provide value to support a company’s share price.

Dolly Varden Silver has invested tens of millions of dollars and completed thousands of metres of drilling on our 100% owned project to be able to calculate a resource of high-grade silver and gold.

While we are an exploration company as we are seeking to grow additional resources of precious metals, our existing resources of silver and gold have significant value and as I’ve said provide natural leverage to prices.

Our silver and gold resources are assets which support our ability to raise addition funds, to further build resources, which in turn can offer investors further leverage to precious metals.

The New Dolly Varden Silver: A Rare Company

With our acquisition of Homestake Ridge we now have significant resources of both silver and gold located in a safe jurisdiction.

This is rare as most primary silver deposits and mines are found in developing countries such as Mexico or those of South America.

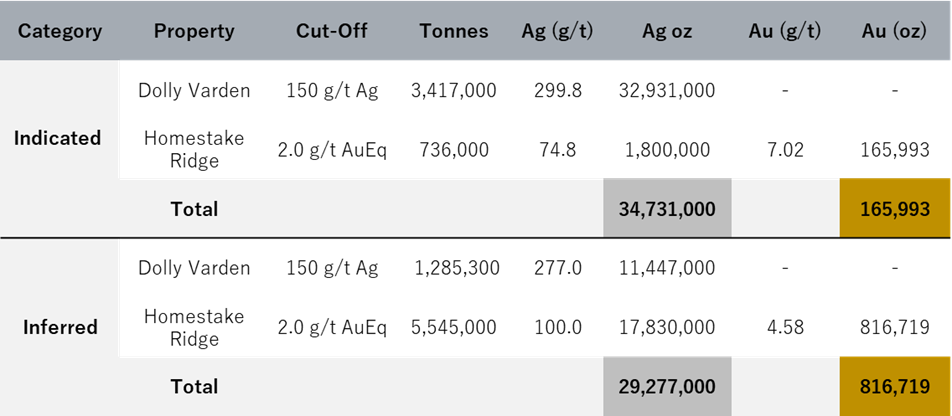

As you can see from the following table our Kitsault Valley project’s combined resources include in excess of 34 million ounces of silver in the Indicated category and 29 million ounces of silver in the Inferred category along with nearly 166 thousand ounces of gold in the Indicated category and 817 thousand ounces of gold in the Inferred.

Bigger is better in mining as the more minerals you can potentially extract during a mine’s life the more cash flow and profits you can generate.

And our acquisition of Homestake Ridge has nearly tripled our resources.

Kitsault Valley Project Combined Resources

Note: Indicated and Inferred Mineral Resources are not Mineral Reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability. There has been insufficient exploration to define the inferred resource as an indicated or measured mineral resource, and it is uncertain if further exploration will result in upgrading the resource to a measured resource category. There is no guarantee that any part of the mineral resource discussed herein will be converted into a mineral reserve in the future. See additional resource disclosure in our public disclosure which can be found on www.sedar.com

By unify the highly prospective Kitsault Valley mineral trend, we have built Dolly Varden Silver into a company with a significantly larger resource base which can share the costs advancement thereby increasing the potential for our Kitsault Valley project to be developed at a future date.

Our Kitsault Valley project now has an impressive silver equivalent resource of 47.2 million Indicated* and 90.5 million Inferred* providing significant leverage to rising silver prices.

*AgEq assumes a gold:silver value ratio of 75

Plus, the resources are all silver and gold, no base metals, which is ideal for investors like you who want exposure to precious metals in their portfolios.

While other companies report silver equivalents with base metals of lead and zinc, which can be very volatile, Dolly Varden is all silver and gold.

Plus our combined silver equivalent resources exceed 100 million ounces, one of the requirements industry often looks to when evaluating the size of a project to determine its potential viability.

In recent years there has been a trend for silver companies to diversify into gold to make their production more diversified.

Gold prices are very stable since gold is owned/purchased by central banks as the king of money. Dolly Varden’s project now has gold in addition to silver, which means stability with the potential leverage and returns from silver.

The Kitsault Valley Project: Size Meets Grade

Benefits of the combined Kitsault Valley project

As the CEO of Dolly Varden Silver, I can tell you we worked hard for our shareholders to acquire Homestake Ridge on an accretive basis.

And I can’t tell you how delighted I am that these projects are finally together as it is truly the most logical next step in their advancement.

While the Homestake Ridge acquisition greatly increases the potential for the combined project to be developed and is accretive to Dolly Varden shareholders, the reasons we are completing it go far beyond these two reasons.

Not only will shareholders benefit from economies of scale including:

- sharing of workforce

- permitting, community and stakeholder engagement, and

- technical studies

…there are significant synergies including knowledge of the geology of both projects and the potential for further discovery.

While in many ways Fury didn’t want to sell Homestake, they wanted to because they knew it was in the best interests of their shareholder due of the synergies the combined project offers both companies.

And by selling the project for shares in Dolly Varden, Fury will share in the upside of the new Dolly Varden as we explore for more silver and gold and seek to de-risk the project.

Furthermore, by selling Homestake Ridge, Fury Gold Mines management is now able to focus on advancing its other gold projects while sharing in the benefits of the combined Kitsault Valley Project.

Opportunities to advance the project going forward

Significant opportunities to unlock value on the combined project exist and we are evaluating these opportunities and the potential timing of implementing them based on various factors.

Potential opportunities to unlock further value in the combined project include:

- Step out holes from existing silver and gold resources to discover additional resources

- Infill drilling to increase the resource category classification from Inferred to Measured and Indicated

- Exploration drilling of underexplored areas

- Updated resource studies and other studies

The crown jewel of the acquisition could be the exploration potential

Beyond the potential benefits to the transaction so far discussed, including nearly tripling the resources of precious metals and cost savings, we believe the exploration upside potential to be the crown jewel of the combined Kitsault Valley project.

All deposits are found in the Kitsault Valley which offers approximately 15 kms of strike length for discovery. And in the middle near the past border of the Homestake Ridge and Dolly Varden projects is a 5.4km underexplored area where we believe has the potential to find more deposits.

This can be plainly seen from the map as the deposits are found on either side of the Kitsault Valley trend which is highly mineralized. It makes intuitive sense that significant potential exists to find more deposits in this middle area as the deposits found thus far are on strike.

Our knowledge of the geology based on geophysics, geochemistry and drilling also points to the potential for this 5.4km area to host additional gold and/or silver deposits.

Project location has the potential to grow in value and importance

I previously mentioned how our project is located in the Golden Triangle of British Columbia, a safe jurisdiction. We believe this provides another value driver going forward as we believe precious metal projects in safe jurisdictions will command higher valuations.

In recent years we have started to see more left leaning political movements in countries around the world. They are often anti-mining, pro-taxation and pro-nationalization.

As a businessperson this is very disappointing and will mean higher costs and lower supply of the critical metals we need in the 4th industrial revolution of which silver is a critical component.

We literally can’t live without these critical metals used in computers and other electrical devices that will power our transition to electric vehicles, robots and artificial intelligence.

The pandemic has placed untold financial burdens on countries and many countries around the world have been given financial relief since they haven’t been able to pay the interest on their debts.

This situation is not going to resolve itself over night, even as the pandemic becomes endemic.

What does this all mean for Dolly Varden and other silver projects located in safe jurisdictions?

It means these projects will likely trade at higher valuations to their peers located in less stable countries.

Furthermore, it is likely projects located in safe jurisdictions will become more attractive targets for acquisition from major mining companies.

In fact, major mining companies are already be waking up to this fact.

Majors have been on a buying spree in 2020 and 2021 of projects in safe jurisdictions like the Golden Triangle of British Columbia, where our Kitsault Valley project is located.

In recent years we have seen Newmont buy GT Gold, Newcrest Mining agree to buy Pretium Resources and a majority interest in the Red Chris mine along with Yamana completing a major financing with Ascot Resources.

The future of the Golden Triangle, British Columbia looks ever brighter with more acquisitions likely in the years to come, right in Dolly Varden’s back yard.

Hecla Mining tried to buy Dolly Varden Silver in 2016

That’s correct.

Hecla Mining, one of the oldest mining companies in America, celebrating its 130th birthday in 2020, attempted a hostile bid to acquire Dolly Varden in 2016.

As one of the largest silver producers in the world and the largest in the US, Hecla Mining owns a property right next to Dolly Varden’s called the Kinskuch project. It is a large 594 sq. km land package without any defined resources of silver or gold.

At that time, Dolly Varden’s management didn’t want to sell the company because it felt the company could develop more value for shareholders before a sale… wanting a higher price tag.

While the takeover was unsuccessful, Hecla continues to be a major investor in Dolly Varden Silver owning just over 10% of the company.

And on closing of the Homestake Ridge acquisition, made a further $5.3 million investment in Dolly Varden which shows their continued support and interest in our new Kitsault Valley project.

Could Dolly Varden be acquired in the future? There’s potential, especially due to our larger resource base with our recent acquisition of Homestake Ridge. However, there will likely need to be a few things completed before that happens… but all options are on the table.

In the meantime, we will continue to focus on building silver and gold resources and finding additional ways to advance our project to build shareholder value while providing investors natural leverage to gold and silver prices.

Dolly Varden Silver: Growing Resources of Silver and Gold in a Safe Jurisdiction

I don’t know what the future holds for our world.

I expect things could get very rocky in the years to come. The volatility of all assets, including gold and silver and the mining companies that produce them will likely increase.

However, I believe those investors with a longer time horizon and who are able to stay the course will be rewarded. I believe it so much that physical gold and silver along with exploration and development mining companies are where I have invested a significant amount of my own capital.

While we can’t control financial markets, my team and I at Dolly Varden have within our control the ability to make wise decisions.

And in the coming years we will seek to grow our silver and gold resources in an accretive manner, to build value for shareholders, just as we have demonstrated with our recent acquisition of Homestake Ridge.

The acquisition of Homestake Ridge is a major step in our plan and I look forward to finding other ways including discovery to increase value to shareholders.

I invite you to subscribe to our Dolly Varden Silver Investor VIP email list where we will provide you further information and news so you too can join in our journey.

Yours truly,

Shawn Khunkhun

CEO, PRESIDENT & DIRECTOR OF DOLLY VARDEN SILVER

Cautionary Statement

This presentation may contain forward-looking statements that are not historical facts. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the timing and costs of future exploration activities on Dolly Varden Silver Corporation (“Dolly Varden”) properties; success of exploration activities; permitting timelines and requirements; requirements for additional capital; environmental requirements; planned exploration and development of properties and the results thereof; planned expenditures and budgets and the execution thereof. Often, but not always, forward-looking statements can be identified by the use of words such as “expects,” “plans,” “estimates,” “intends,” “believes,” “could,” “might,” “will”, “budget”, “scheduled”, “forecasts”, “anticipates”, “potential”, “base case” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward looking statements or information relates to, among other things, Dolly Varden’s corporate strategies, mineral resource estimates and plans for further exploration, which will require additional funding. These forward looking statements are based on management’s current expectations and beliefs (including the belief in the accuracy of the resource estimate) but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. Information in this presentation is not intended to be a comprehensive review of all matters and developments concerning Dolly Varden and Dolly Varden does not assume any obligation to update, or to publicly announce, any such statements, events or developments, except as required by law. For additional information on risks and uncertainties, see Dolly Varden’s most recently filed annual management discussion & analysis (“MD&A”), which is available on SEDAR at www.sedar.com and on Dolly Varden’s website at www.dollyvardensilver.com. The risk factors identified in the MD&A are not intended to represent a complete list of factors that could affect Dolly Varden.

Compliance with NI43-101

The technical information in this website (the “Technical Information”) has been approved by Rob van Egmond, P.Geo. and a Qualified Person. For readers to understand the information in this presentation, they should read the technical report (available www.sedar.com) in its entirety (the “Technical Report”), including all qualifications, assumptions and exclusions that relate to the information set out in this presentation that qualifies the Technical Information. The Technical Report is intended to be read as a whole, and sections or summaries should not be read or relied upon out of context. The Technical Information in the Technical Report is subject to the assumptions and qualifications contained therein. Some of the mineral resources at the Dolly Varden Property are categorized as indicated and some as inferred mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates include inferred mineral resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that these inferred mineral resources will be converted to measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied.